We’re taught to chase jobs, degrees, and security. But rarely do we stop to ask: Is this freedom? That question haunted me after reading Rich Dad’s Cash Flow Quadrant by Robert Kiyosaki. This wasn’t just another personal finance book—it was a mind opener. It introduced me to a model that helped me rethink my relationship with money, risk, work, and time.

The Cash Flow Quadrant breaks down how people earn money into four simple categories, but its impact goes far deeper. It taught me lessons beyond wealth—building about purpose, control, mindset, and freedom.

Here are the 10 biggest lessons the Cash Flow Quadrant taught me: life, work, and building something that genuinely works for me.

Table of Contents

1. The Real Goal in Life Isn’t Just a Job

I used to believe that success meant getting a “good job, ” studying hard, getting a degree, finding something stable, and avoiding risks. But The Cash Flow Quadrant challenged that belief.

It made me pause and ask: What if life isn’t about job titles or climbing corporate ladders? What if our fundamental mission is to find purpose—and have the time and freedom to live it?

That hit me harder than I expected. Security is nice, but freedom is the real goal.

2. School Taught Me to Be Careful, Not Courageous

Looking back, school never taught me how to manage money or take smart risks. It taught me to follow instructions and fear mistakes.

But the real world rewards those who take chances—who try, fail, and grow.

That’s a different kind of intelligence. Outside the classroom, emotional resilience matters more than straight A’s. Traditional education mainly prepares us to survive on the left side of the Cash Flow Quadrant (Employee and Self-Employed)—not thrive on the right (Business Owner and Investor).

3. The Four Ways We Make Money

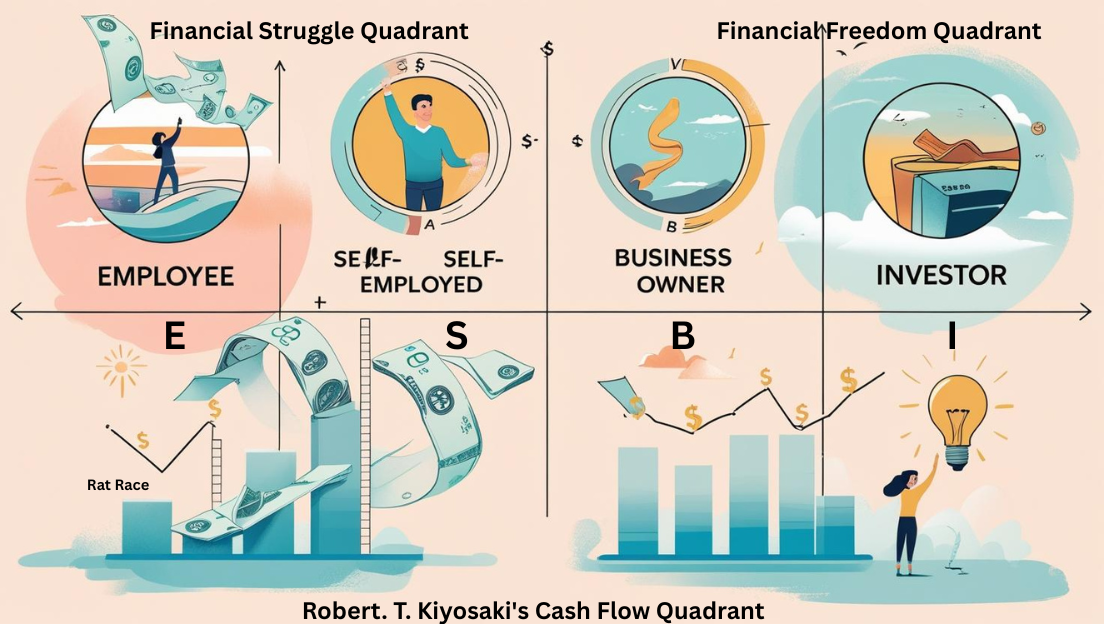

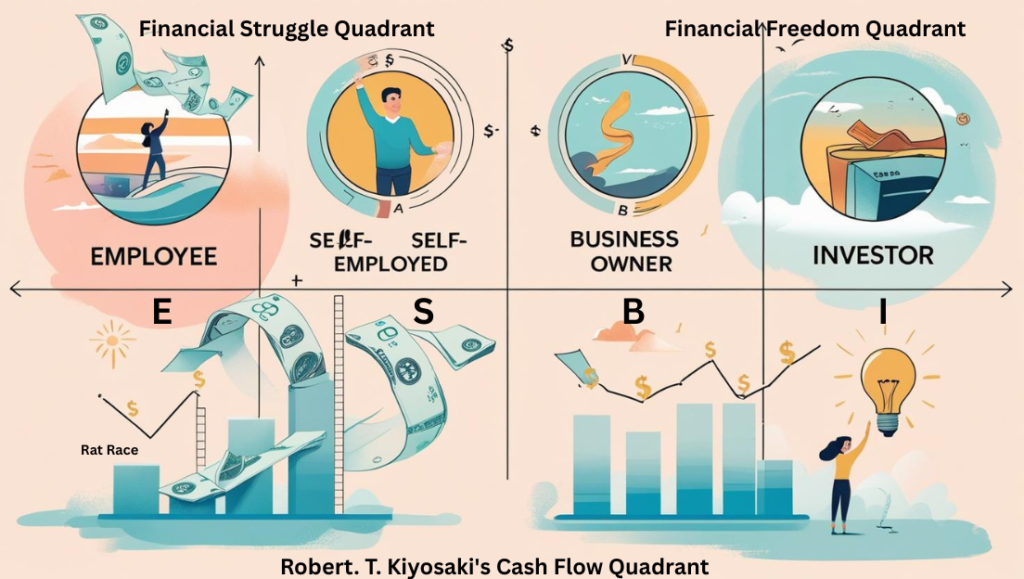

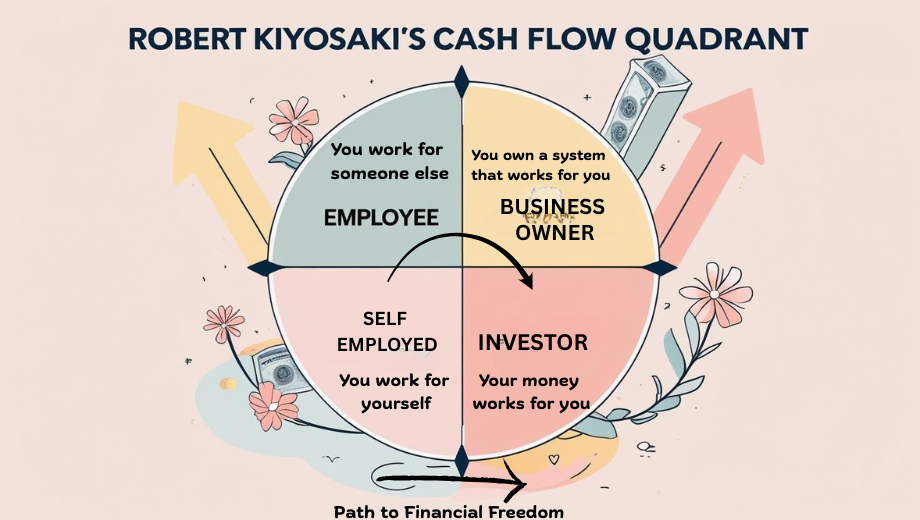

The heart of the Cash Flow Quadrant is simple, yet life-changing. Kiyosaki categorises how people earn money into four quadrants:

- E (Employee) – You work for someone else.

- S (Self-Employed) – You work for yourself.

- B (Business Owner) – You own a system that works for you.

- I (Investor) – Your money works for you.

Most people stay stuck on the left side (E and S), trading time for money. But financial freedom—the kind that lets you live on your terms—lies on the right side (B and I), where cash and systems generate wealth, not just effort.

4. Investing Is Not Gambling—If You Know What You’re Doing

Before this book, I used to think investing was just glorified gambling. Stocks, real estate—it all looked risky and unpredictable.

But the Cash Flow Quadrant shattered that illusion. The difference is knowledge.

Real investors don’t bet—they build. They study the markets, understand risks, create systems, and make data-driven decisions. While gamblers hope to win, investors prepare to grow. Investing is not about luck but building long-term wealth with discipline and intention.

5. We’re Addicted to the Paycheck—And Don’t Even Know It

One of the most eye-opening ideas in the book was our emotional addiction to the paycheck.

We get used to a steady salary, and it becomes hard to imagine life without it. That comfort turns into a cage. We stop exploring new ways to earn, because the regular hit of a paycheck feels safe.

But absolute freedom begins when you break that emotional dependency and start building income streams that don’t rely on clocking in every day.

6. Risk Isn’t the Enemy—Not Knowing Is

We often fear risk because we don’t understand it. But the Cash Flow Quadrant taught me that risk is not the enemy—ignorance is.

When something feels risky, we often lack knowledge or experience. But once we educate ourselves, what seemed like a leap becomes a calculated move.

Taking risks is essential for growth. Without it, we stay in our comfort zones, and comfort zones rarely lead to financial freedom.

7. Opinions Won’t Help You—Facts Will

One of the most powerful lessons I learned was to stop making money decisions based on opinions.

Everyone has financial advice, but few truly understand what they’re discussing. That’s why learning to read financial statements is non-negotiable.

Once you know your numbers—your income, expenses, assets, and liabilities—you stop depending on guesswork. You make smarter, data-backed decisions. Financial literacy gives you clarity and control.

8. It’s Not About How Much You Make—It’s About Where It Goes

The Cash Flow Quadrant helped me understand a harsh truth: earning more doesn’t mean you’re financially better off.

Doctors and executives with six-figure salaries still live paycheck to paycheck. Why? Because they don’t understand how money flows through their lives.

It’s not about the amount but how effectively you manage it. Are you building assets or just paying bills? Are you growing your net worth or standing still?

The quadrant taught me to focus on cash flow, not just income.

9. Debt Isn’t Always Bad—If It’s Smart

This book completely reframed my understanding of debt. I used to think avoiding debt was the goal.

Now I realise that it’s not about avoiding debt; it’s about using it smartly. Smart debt builds assets that generate income, like a rental property that pays for itself.

Bad debt, like credit cards and loans for depreciating things, only drains you.

The key is knowing the difference—and making debt work for you, not against you.

10. If You Want to Get Rich, Solve Bigger Problems

Ultimately, the Cash Flow Quadrant is not just about money—it’s about mindset.

People on the B (Business Owner) and I (Investor) side of the quadrant think differently. They solve bigger problems, create more value, and build systems that grow without their constant involvement.

Wealth isn’t just earned—it’s created. And it starts by shifting how you think about time, value, and freedom. The bigger the problem you solve, the greater the financial and personal growth opportunity.

Read also: Rich Dad Poor Dad: 11 Life-Changing Perspective on Money and Success

Final Thoughts: Build a Life That Works for You

The Cash Flow Quadrant didn’t just change how I see money—it changed how I see life.

It reminded me that I have choices. I can learn new skills, think differently, and build something that gives me time, freedom, and purpose.

For me, this wasn’t just a book—it was a mirror and a map.

So now I often ask myself: Am I building a life that reflects who I am, or just maintaining one that pays the bills?

Because honestly, I’d rather stumble chasing freedom than succeed staying stuck.

Liked this reflection?

If this article resonated with you, feel free to share it, comment below, or check out more reflections on wealth, mindset, and financial freedom.