Money isn’t just about numbers; it’s about behaviour, patience, and emotions. That’s the core idea behind The Psychology of Money by Morgan Housel. The book shows us that financial success is less about intelligence and more about how you manage your thoughts, fears, and habits. In this blog, I’ll dive deep into the lessons from The Psychology of Money, share personal stories, and explain why mastering your behaviour is more potent than mastering the stock market.

Why The Psychology of Money Matters

We live in a world where financial advice often comes down to calculations, charts, and formulas. But The Psychology of Money reminds us that wealth-building is not purely logical. People aren’t robots. We often experience feelings of greed, fear, envy, pride, and even shame when it comes to money. These emotions drive our financial decisions more than spreadsheets ever will.

For example, two investors with the same salary, portfolio, and opportunities can end up in very different financial places. Why? Because their psychology around money is different. One may panic-sell during a downturn, while the other holds steady. The Psychology of Money teaches us that mindset is the real game-changer.

Lesson 1: No One Is Crazy with Money

One of the most striking ideas from The Psychology of Money is that no one is truly “crazy” with money. Everyone makes decisions that make sense to them, based on their own experiences. For someone who lived through the Great Depression, holding cash under a mattress feels rational. For a millennial who grew up during the 2008 crisis, avoiding stocks might feel safe. Your view of risk, safety, and reward is shaped by the era you grew up in.

This is why judging others’ financial choices rarely makes sense. Instead, we should recognise that our personal histories shape our money psychology.

Lesson 2: Luck and Risk Matter More Than We Think

Housel stresses in The Psychology of Money that financial outcomes are often influenced by luck and risk as much as skill. Bill Gates attended one of the world’s first high schools with a computer in 1968. That stroke of luck shaped his career. Meanwhile, someone equally bright and hardworking, but born in a different environment, may not achieve the same level of success.

Recognising the roles of luck and risk humbles us. It reminds us not to take too much credit for wins—or place too much blame for losses. The Psychology of Money urges us to stay humble and empathetic.

Respect the role of luck and risk. Success is never entirely your doing, and failure is never entirely your fault.

Lesson 3. Everything Has a Price

Every financial reward comes with a cost. A luxury car costs money. Investing in stocks costs emotional resilience. High returns come with high volatility.

The mistake most people make is pretending the price doesn’t exist. They want wealth without risk, reward without sacrifice. However, the truth is that the market always extracts a fee.

Treat volatility as a fee for long-term growth, not as a fine for doing something wrong.

Lesson 4: Never Enough

The book’s chapter “Never Enough” shows how chasing wealth without boundaries can lead to misery. Consider the story of Rajat Gupta, a successful businessman who already had everything but wanted more. His greed led him to engage in insider trading and ultimately resulted in his imprisonment.

The Psychology of Money reminds us that happiness doesn’t always grow with money. Contentment is wealth, too.

Decide what “enough” means for you. Protect it fiercely. Peace of mind is wealth’s ultimate reward.

Lesson 5: The Power of Compounding

Compounding is often misunderstood. The Psychology of Money illustrates how Warren Buffett built most of his wealth not because he’s the most intelligent investor alive, but because he started investing at the age of 10 and continued for decades. His secret wasn’t genius—it was time.

This shows us that patience beats brilliance. The earlier you start, the more time compounding has to work its magic.

Great fortunes rarely come from extraordinary returns; they come from good returns sustained over the course of decades.

Lesson 6: Tails Drive Everything

Another brilliant insight from The Psychology of Money is that a small number of events often shape financial outcomes. For investors, just a few big wins (or losses) can define decades of results. Amazon, for example, had many failures, but its few massive successes outweighed them all.

This lesson is both comforting and sobering. It means you don’t need to be right all the time. But it also means you must survive long enough to benefit from those rare wins.

Survival matters more than accuracy. You don’t need to win every time. You need to avoid being wiped out.

Lesson 7: Freedom Is the Ultimate Dividend

Housel explains that the ultimate goal of money is freedom—the ability to control your time. The Psychology of Money emphasises that wealth is not Ferraris and mansions; it’s waking up and deciding what you want to do today.

When I first read this chapter, it struck me deeply. I realised that my savings weren’t just numbers; they were units of time I was buying back for myself. True wealth is control over your schedule.

Savings = Control over time. And control is the highest dividend money pays.

Lesson 8. Wealth Is Income Minus Ego

The insights from the Psychology of Money are invaluable during financial downturns.

By studying the Psychology of Money, we gain a deeper understanding of the relationship between our emotions and investments.

Wealth doesn’t come from how much you earn—it comes from how much you keep. Ego pushes us to spend on cars, gadgets, and status symbols to impress others. But true wealth grows when the ego is subdued.

The formula is simple: Wealth = Income – Ego-driven Spending.

To grow wealth, prioritise savings over showing off. The less you need to prove, the more freedom you can buy.

Lesson 9: Save Money, Even Without a Goal

One of my favourite takeaways from The Psychology of Money is to save money even when you don’t have a specific reason. Life is unpredictable. Emergencies, opportunities, and crises will appear when we least expect them. Savings give you flexibility and peace of mind.

I once faced a medical emergency that drained more than I anticipated. The only reason I didn’t collapse financially was that I had savings set aside. As Housel says in The Psychology of Money, savings are the gap between your ego and your income.

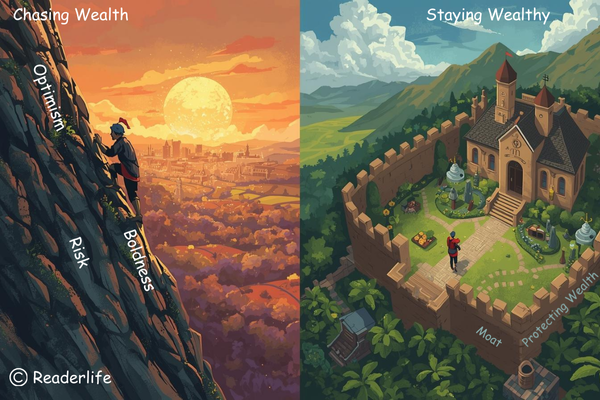

Lesson 10. Getting Wealthy vs. Staying Wealthy

Building wealth and keeping wealth require opposite skills. Achieving wealth often requires taking risks, maintaining optimism, and making bold moves. Staying rich demands caution, humility, and resilience.

Many who rise quickly fall faster because they continue to play the same aggressive game. The key to long-term wealth is survival.

Staying in the game matters more than winning once.

Lesson 11: Reasonable > Rational

The Psychology of Money argues that being reasonable with money is more important than being perfectly rational. Rational assumes you always act in your best financial interest. But humans don’t operate like that. Sometimes, paying off a small debt for peace of mind makes more sense than investing that money mathematically.

Being reasonable means finding a balance between logic and peace of mind. It’s okay to make decisions that help you sleep better at night, even if they aren’t the “optimal” financial move.

Sustainability beats perfection. Reasonable > Rational in personal finance.

Lesson 12. The Seduction of Pessimism

Why do pessimists sound smarter than optimists? Because setbacks happen quickly and dramatically, while progress takes time and often goes unnoticed.

Bad news grabs attention: a market crash makes headlines overnight. But steady long-term growth rarely makes the news. This skews our perception toward fear.

Through the concept of “The Seduction of Pessimism, Morgan Housel urges readers to recognise that optimism pays, but it requires patience. Don’t let fear disguised as wisdom derail your strategy.

Lesson 13: You’ll Change Over Time

One powerful reminder from The Psychology of Money is that your financial goals will evolve. What you want in your 20s won’t be the same as what you want in your 40s or 60s. This means flexibility is crucial. Don’t lock yourself into financial plans that assume you’ll never change.

The goals you have today may not be the goals you’ll have 10 years from now. This “end of history illusion” makes long-term planning tricky.

It is better to have flexibility in planning and avoid extreme commitments. Aiming for moderation can help your financial strategy evolve with you.

Also read: “The Richest Man in Babylon”: 9 inspiring wealth lessons

Conclusion: The Timeless Value of The Psychology of Money

What makes The Psychology of Money stand out is its timelessness. It’s not a guide to the hottest stock tips or the latest financial hacks. It’s a reflection on human nature and its interaction with wealth. The book teaches us that money is not about beating the market—it’s about managing ourselves.

If there’s one takeaway from The Psychology of Money, it’s this: Wealth is less about how smart you are and more about how you behave. Patience, humility, savings, and self-awareness will take you farther than intelligence ever could.